Functional Food and Beverages Go Mainstream

As we enter year two of the pandemic, consumers continue to prioritize their health and wellness needs. According to McKinsey & Co’s “Future of Wellness”, they revealed:

1. 79% of worldwide consumers said they believe wellness is important, and

2. 42% consider it a top priority.

Today, more and more consumers understand the correlation between food and health and

seek foods and beverages that will help them more aggressively meet their unique nutrition and personal health goals. Consumers are increasingly taking responsibility for their wellbeing, with functional foods ideally placed to address these specific requirements. During the pandemic, 40% of consumers increased their purchases of functional foods and beverages.

What are Functional Foods?

“Functional foods are foods that have a potentially positive effect on health beyond basic nutrition. Proponents of functional foods say they promote optimal health and help reduce the risk of disease”. “These foods are not intended to only satisfy hunger and provide the necessary human nutrients, but also to prevent nutrition-related diseases and increase the physical and mental well-being of their consumer.”

Market Size for Functional Foods

The global functional food and beverage market is projected to grow in sales from $281.1B USD in 2021 to $529.7B USD in 2028, growing at a Compounded Annual Growth Rate (CAGR) of 9.5% in the 2021-2028 period. The Canadian functional food and beverage market is projected to reach $19.2B by 2026, growing at a CAGR of 6.3% between the period 2021-2026.

The Functional Foods Consumer

Functional food ingredients that support better sleep, reduced stress, and improved focus are in demand and driving product innovation. Those consumers under the age of 55 are more aware of and utilize products that offer functional benefits. Shifting demographics are positioning this market for sustained growth, as Millennials and Gen Z are already the most engaged demographic in functional product usage. Those consumers over the age of 65 (in Canada, this demographic is expected to grow by 68% over the next 20 years ) represent opportunities to grow the audience for this sector.

Top New Product Launches Containing Functional Claims

The snack/cereal/energy bar category accounted for the largest share (20%) of new food product launches containing functional claims in 2020:

1. Snack / Cereal / Energy: 20%

2. Cold cereals: 11%

3. Spoonable yogurts: 5%

4. Nuts: 5%.

Innovation in the beverage space centered around meal replacements which accounted for 28% of new beverage launches containing functional claims in 2020:

1. Meal replacements: 28%

2. Energy drinks: 16%

3. Tea: 15%

4. Flavoured water: 11%.

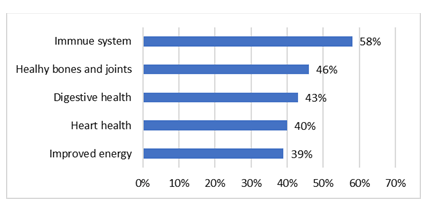

Why are Consumers Buying Functional Foods and Beverages?

The immune system and healthy bones and joints are the top 2 reasons why consumers are purchasing healthy lifestyle products, as outlined in Chart 1 on page 3.

Chart 1

Top Reasons for Purchasing Healthy Life Style Products

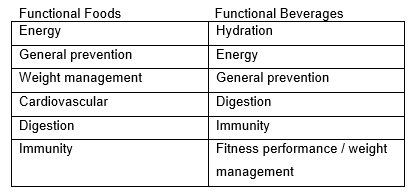

The Hartman Group asked consumers why they use functional foods and functional beverages. Table 1 shows the top 6 reasons for each category.

Table 1

Top 6 Reasons to Buy Functional Foods or Functional Beverages

Are Functional Food and Beverages a Fad?

While the pandemic may have accelerated this trend,” functional foods are no flash in the pan, experts insisted at Food Navigator’s Positive Nutrition Digital Summit”. As part of Kerry’s global survey in 2021, they revealed as many as 39% of consumers had used an immune health product over the past six months and a further 30% would consider doing so in the future, suggesting a total potential immune health market of 69%.

References:

[1] McKinsey’s “Future of Wellness” Survey Identifies Six Wellness Trends Gaining Momentum, www.sgbonline.com, April 2021

[2] 40% of Consumers Purchased Functional Products During the Pandemic, www.foodabdbeverageinsider.com, June 2021

[3] Nutrition and Healthy Eating, www.mayoclinic.org

[4] An Overview of the Functional Food Market, www.pubmed.ncbi.nlm.nih.gov

[5] Functional Food and Beverage Market Size, www.fortunebusinessinsights.com, May 2021

[6]Canada Functional Foods and Natural Health Products Market Overview, www.industryarc.com

[7] Infographic: Canada’s Seniors Population Outlook: Uncharted Territory, www.cihi.ca

[8] Shifting Demographics Poise Functional Products for Growth, www.foodbusinessnews.net, September 2021

[9] Shifting Demographics Poise Functional Products for Growth, www.foodbusinessnews.net, September 2021

[10] Four in Ten Consumers Have Bought More Functional Products During Pandemic, Kerry Survey, www.foodcanada.com, June 2021

[11] Covid-19 Increases Consumer Demand for Functional Foods and Beverages, www.foodindustryexecxutive.com, September 2020

[12] Functional Food Is No COVID Fad, www.foodnavigator.com, March 2021

[13] 40% of Consumers Purchased Functional Products During the Pandemic, www.foodabdbeverageinsider.com, June 2021