The Rise of the Local Market

The pandemic has had a lasting impact on consumer shopping habits. Today, many consumers are still wary of crowded retail stores. According to the Numerator Canadian Consumer Sentiment Survey, Canadian consumers are still looking down the road when it comes to timing expectations for a return to normal. Only 2 in 3 are expecting a return to normal to be sometime in 2022, down from March (82%).[i] One of the biggest changes in shopping habits has been consumers’ willingness to shop online which was pretty stagnant prior to the pandemic. The 2nd biggest change is their interest in supporting local. During the pandemic, small retail, and food service businesses were shut down nationally as they were deemed not to be an essential service. What a shame. A Republican Governor in the US stated her state did not shut down any businesses during the pandemic. In her own words, “All Businesses are Essential”.

The Rise of the Local Market

Collins dictionary defines local as “existing in or belonging to the area you live, or to the area that you are talking about. The locals are local people. As noted by Laurel Winter, Farm Manager at Winter’s Turkeys,

“In recent years, consumers have become increasingly interested in supporting ‘local’ and knowing where their food is coming from. Rather than sparking a new trend, the pandemic appears to have simply accelerated a trend that was already happening, she said.”[ii]

According to a survey undertaken in 2020, titled Making Loyalty Work for Small Businesses, they revealed over half of the consumers globally (53%) believe it is more important to shop with local businesses now than it was before the pandemic.[iii] Today, from coast to coast, Canadians are increasingly seeking and purchasing local products in supermarkets, online, at farmers’ markets, and through curated marketplaces.

Factors Pushing Buy-Local mindset

According to the Business Development Bank of Canada (BDC), two factors appear to be pushing the buy-local mindset:

- Support the local economy.

- The belief Canadian-made products are safer and greener alternatives to imports.

As part of their survey, they also revealed that 45% of respondents have made an effort to buy Canadian.[iv]

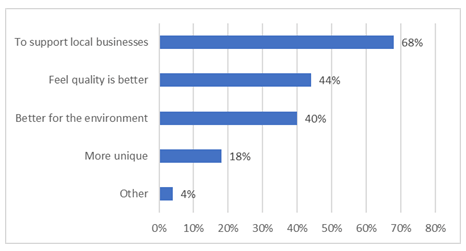

The February edition of Canadian Grocery included a research study on how Canadians size up grocery shopping. As part of their study, they dwelled on “A Love for Local”. Chart 1 outlines the Top 5 reasons Canadians purchase locally-produced products.

Chart 1

Reasons for Purchasing Locally-Produced Products

As part of the same study, they revealed 85% of consumers purchase locally made products at grocery sometimes or always.[v]

One of the biggest barriers for made-in-Canada products in the past has been the retail price point. The BDC survey revealed that 24% of consumers are willing to pay a premium to buy locally produced products, and 65% cited food as a product they are willing to pay more for. On average, consumers are willing to pay between 5% and 10% more.[vi]

Though many Canadian retailers including Loblaws, Sobeys, and Metro are dedicated to supporting local businesses, these brands must understand their product’s keys to success are dependent upon:

- Offering a unique point of differential! What is your brand’s point of differential? Canadians are open to trying new and exciting products.

- Offering a product that is priced competitively! Can the product be competitively priced? As noted by BDC, Canadians are willing to pay only 5% to 10% more.

- Generating product awareness! Have a Canadian-made marketing plan to generate awareness, and stimulate trial purchases. As noted by BDC, buying local is not the first instinct of many Canadians.

Though the food sector is extremely competitive, small local brands have a role to play and can be extremely successful as these brands tend to be more focused and vocal about their commitments to the broader “good”. As noted by the IRI (Data analytics and market research company), “Of the CPG industry $933 billion of total US sales in measured channels in 2020, the large manufacturers collectively lost 1.3 share points or $12.1B in sales to smaller players”.[vii]

References:

[i] Inflation, Indoor Dining’s Impact on Grocery, Cold & Flu Sales, and More, www.numerator.com, April 2022

[ii] Will Covid Change Consumer Interest in Local, www.canadiangrocer.com, June 2020

[iii] Pandemic Drives over Half of Consumers to Shop Locally: Bank Data Key in Enabling SMEs to Compete with Big Businesses, www.pollinate.co.uk

[iv] Oh Canada, www.grocerybusiness.ca, January / February 2022, Mario Toneguzzi

[v] Inside the Minds of Shoppers, www.canadiangrocer.com, February 2022

[vi] Oh Canada, www.grocerybusiness.ca, January / February 2022, Mario Toneguzzi

[vii] Large CPG Companies Lose Market Share to Smaller Competitors Despite Surging Sales Spurred by the Pandemic, www.foodnavigator-usa.com, February 2021