The Flight of the Private Label Category

In 1983, Loblaws conceived their first private label brand which they launched in 1984 – President’s Choice chocolate chip cookies, and ground coffee. Today Loblaws markets store brands under 4 different brand names: 1. President Choice, 2. No Name. 3. Blue Menu, 4. PC Black label. They have since been joined by lines such as Compliments at Sobeys, Kirkland at Costco, and Irresistible at Metro. This is a date to be remembered given global private-label food and beverage sales are forecasted to top $215.8 USD Billion by 2028.[i]

Canadian Private Label Sales and Market Share

Private label store brands have raised in popularity with retail sales of more than $14B in 2017.[ii]

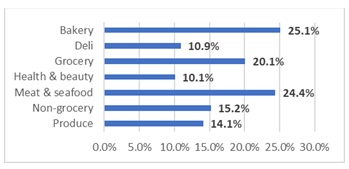

The Canadian private-label food and beverage market is expected to grow with a Compounded Annual Growth Rate of 5% for the 7-year period ending in 2029.[iii] As a result of the pandemic, private label sales continue to grow. For the 5-month period ending May 21, 2022, private label sales were +8%[iv] and 49% of Canadians were considering purchasing more private label packaged goods.[v] For the 20-week period ending June 04/2022, private labels’ market share was 18.3%. This represented a +0.3% increase over the past 5 months.[vi] Converted to volume, this share jumps to 23.6%[vii]. European counterparts’ private label dollar market share is +30%.[viii] For the 16-week period ending April 2022, bakery, meat & seafood, and grocery represented the three biggest private label departments in terms of market share as outlined in Chart 1.[ix]

Chart 1

Private Label Market Share by Department

Private Label Market Share by Banner

Loblaws holds a commanding lead for the percentage of private label units sold (44%) for the 6-month period ending June 2022. The top 5 banners in Canada accounted for 91% of all private label unit sales.[x] Loblaws (44%); Walmart (17%); Sobeys (11%); Metro (11%); Costco (8%)

Private Label Consumer

During the month of June 2022, 89% of Canadians report having bought a private label product, with price (45%) being the top primary motivation for the purchase. Numerators’ study also revealed only 16.8% of private label buyers will return to premium brands once inflation subsides.

“Contrary to assumptions, there are negligible differences in grocery spending across income, but those making over $80,000 contributed 5% to private label growth, far outpacing other income brackets. By comparison, middle-income earners – those making $40,000 to $80,000 – have contributed only 1% of growth.”[xi] Chart 2 supports the assertion there are negligible differences in private-label shopping by income for groceries.[xii]

Chart 2

Private Label (Groceries) Importance by Income

Canadian households spend on average $1,319 per year on private label products. Forty-Five percent (45%) of Canadians believe private label brands provide better quality than national brands (up from 38% in 2018).[xiii]

Motivators for Purchasing Private Label

To no surprise, price is the number 1 reason why Canadians purchase private label products, followed closely by quality as outlined in Chart 3.[xiv]

Chart 3

Reasons for Buying Private Label Products Among Grocery Shoppers in Canada

Though a private label strategy is not an ideal strategy for each brand, certain brands have been quite successful with a 2-brand strategy. Renee’s who created a new category for salad dressings (refrigerated), marketed their brand and manufactured retailers’ private label format. To be considered by a retailer, the brand’s manufacturing facilities must be Global Food Safety Initiative (GFSI) certified.

If a brand is considering a private label strategy, here are 3 challenges to consider:

- Difficulty in Creating Brand Loyalty: Private label brands lack the name recognition and customer loyalty many brands covet.

- Staying Innovative: Private label manufacturers face the daunting task of remaining innovative, and flexible in pricing. Bigger brands provide ideas for retailers’ private label options.

- Maintain Sales Balance: Private label manufacturers should be cautious not to put all their eggs in one basket. Just as quickly as they picked up the retailers’ private label business, they can also lose it just as fast.

[i] Private Label Food and Beverage Market Set to Reach 215.81USD Billion by 2028, www.digitaljournal.com, July 2022

[ii] Private Label Food Opportunities in the Canadian Market, www.growtrade.ca, February 2019

[iii] Loblaws, Sobeys and Metro Were Dominating Canada Private Label Food and Beverage Market in 2021, www.datebridgemarketresearch.com

[iv] Navigating Disruption, Grocery Business, July / August 2022, Carman Allison

[v] Canadians to Shop Private Label, Spend Less on Grocery Delivery Amid Rising Cost of Living, www.canadiangrocer.com, August 2022

[vi] Private Label, An Inflationary Inevitability, Numerator, 2022

[vii] The Rising Power of Private Label, www.canadiangrocer.com, November 2018

[viii] Amid High Inflation and Supply Chain Issues, Private Label Powers Up, www.canadiangrocer.com, October 2022

[ix] Nielsen IQ Canada, Annual Fast Moving Consumer Goods Review, 2021

[x] Private Label, An Inflationary Inevitability, Numerator, 2022

[xi] High Income Earners are Driving Private Label Growth, www.strategyonline.ca, August 2022

[xii] Private Label, An Inflationary Inevitability, Numerator, 2022

[xiii] Private Label Brands Gain Importance with Consumer: Nielsen IQ, www.grocerybusiness.ca, August 2021

[xiv] Reasons for Buying Private Label Products Among Grocery Shoppers in Canada, www.statista.com, February 2022