GROCERY WARS – “MEAL KITS – THE NEW PHENOMENON”!

The evolution of dual careers has given rise to our ever-escalating “on-the-go” lifestyles. With both Husband and Wife enjoying full-time careers, this leaves them little time to plan for their evening dinner. This has given rise to the new phenomenon in the food sector – Meal Kits. So, what is a meal kit, what is this sector worth, which consumer segment is driving their growth and what has given rise to this new sector?

Meal Kit

A new comer to the Canadian food scene, a meal kit offers fresh, portioned and packaged food, all the ingredients  required to make a meal in one handy kit. The consumer follows the recipe provided and cooks it. In most cases, it is delivered to the subscribers’ door. The success of this service is drawing a small but noticeable bite of business away from traditional supermarkets.

required to make a meal in one handy kit. The consumer follows the recipe provided and cooks it. In most cases, it is delivered to the subscribers’ door. The success of this service is drawing a small but noticeable bite of business away from traditional supermarkets.

Unlike frozen foods that also fundamentally changed how people cook at home, consumers equate fresh, not frozen meals to being healthier and better for you.

Meal Kit Market Growth

The meal kit trend commenced in the U.S. around 2012 and has expanded globally. In the UK, companies that deliver meal kits are gaining traction, growing by nearly 65% in the first half of 2016, compared with the same period in 2015. Globally, meal kit sales are forecast to top $10B dollars by 2020. In the US, meal kit sales topped $1.5B dollars in 2016.

Meal Kit Pricing

Though meal kits have become more popular over the years, they remain a relatively niche part of the food sector. They are not for the faint at heart. In the U.S, the majority of meal kits cost $60 to $75 a week for 3 meals for two people or $130 to $150 a week for four meals for four people. This compares to an average cost of $4 a meal when cooking at home and $10 a meal when ordering at a restaurant. In Canada, Rose Reisman’s Personal Gourmet service deliver meals at about $14 a plate.

Consumer Sector Driving Meal Kit Sector

Though meal kit pricing would seem to align with well – educated households in which both parents hold senior level management roles and incomes well above the family norm, research reveals meal kits also appear to align strongly with Millennials between the ages of 18-35 and even consumers 70+.

Popularity of Meal Kits

More and more Canadians are spending less time cooking meals from scratch at home and increasingly turning to the convenience of meal kits. The NPD Group suggests 75% of all meals are now typically prepared in 15 minutes or less as Canadians rely on more shortcuts in the kitchen. In the U.S., 1% of all food spending now goes to meal kits, with close to 20% of the U.S. population (50M consumers) having an interest in trying a meal kit. Of those who have tried the kits, 67% were either extremely or very satisfied with their purchase, per The NPD Group.

The Rise of Meal Kits

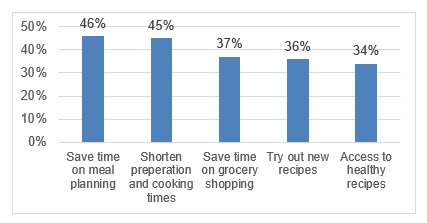

The meal kit has filled a major void in consumers lives. They offer an easy to prepare meal, which saves time and requires little meal planning and tastes homemade. Rightly or wrongly, many consumers also consider meal kits to be a way to eat healthier foods. Harris Insights & Analytics, is a market research firm, known for “The Harris Poll”. They recently concluded a study of the meal kit sector and identified the Top 5 reasons why consumers purchase meal kits as outlined in Chart 1.

Chart 1

Top 5 Reasons Why Consumers Purchase Meal Kits

The immediate future for meal kits is divided. Whereas some analyst believes that high prices for meal kits will discourage consumers once the fad dies down, others see the segment as a lucrative business opportunity that will only broaden in the years ahead.

The Impact on Supermarkets

Canadian supermarket chains are in the midst of flat sales growth. For February 2017, food and beverage store sales in Canada increased .5% (J.C. Williams Group National Retail Bulletin). Though an extremely niche market, meal kits are another source of food for consumers, and this “share of stomach” battle is directly targeting grocery retailers and restaurants. Canadian supermarkets must embrace this new sector or be left behind. In a recent study cited by Technomic,

- 54% of consumers indicated that they would cut back on grocery purchases if they signed up for a meal kit delivery service.

In the UK, research also reveals:

- Consumers who utilize meal kit services spend 2.8% less at Supermarkets, and

- The same consumer also spends 2.2% leas on eating out at restaurants.

Grocery retailers can do well in this space. Today’s consumers want convenience more than ever, and picking up a retailer-branded meal kit at the end of a shopping trip is an easy way for them to quickly get dinner on the table.

Impact for Small Business

Small business should concentrate on the new niche markets and less on those well-established categories. Meal kits is a new niche market and an area in which they could offer an array of difference from the big CPG conglomerates. Even home goods guru Martha Stewart is getting on the bandwagon. This market is viewed by most as a trend, not a fad. Small business must think out-side the box to be different, and this sector represents out-side the box thinking.

For assistance in Getting and Staying Listed in Canada’s Grocery Sector, connect with us through our website: www.fooddistributionguy.com, or give us a call toll free: 1-844-206-FOOD (3662).

Follow us on twitter

Richard Baker@GRMS_Richard